The Durbin Watson Statistic lets us know when good statistical regression analysis has gone bad...like a donut that looks good on the outside, but is actually super stale. Nobody likes a stale donut.

The Durbin Watson Statistic tests a time-series regression for autocorrelation, which we don’t want. Other tests might say “hey, you, your regression is looking good!” while the Durbin Watson Statistic test might say “uhmmm, actually, you should take another look...something’s not right, even if the others tests checked out.” The Durbin Watson Statistic gives a value of 2 if there’s not autocorrelation, or a value above or below 2 (within 0 - 4 range), which means there’s negative or positive autocorrelation.

So what is autocorrelation, and why is it bad? Regressions are functions that try to use a bunch of data to predict something. Basically, regressions are a statistical method to find correlations (it can’t prove causations, though...for that we’ve gotta have experiments) by fitting data to a line. Finding the best line for the data is the goal. How far the data points are from the line is the error, which we want to minimize to get the best fit line.

When there’s autocorrelation, that means your error value of your regression is correlated, either negatively or positively. If your regression “fits” the data well and your errors are correlated, that means something’s wrong. For instance, it could mean that you missed a really important variable that has some explanatory power, which shouldn’t be nested in your error, but a part of your regression line (omitted variable bias).

You can also get autocorrelation when your regression is functionally misspecified, which means your regression doesn’t actually fit the data well, because you have equal errors on both sides of your regression line, showing that you missed something in the relationship...which is kinda the point of doing a regression.

A third way you can get autocorrelation is measurement error in the independent variable, which will cause your independent variable and your error variable to both reflect that measurement error, and you’ll find your errors correlating over time with that measurement error.

Related or Semi-related Video

Finance: What are correlation coefficien...37 Views

Finance allah shmoop what are correlation coefficients Kind of sounds

like a new card game from the makers of cards

against humanity or an exotic disease that spreads like wildfire

on a cruise ship you know been there But a

correlation coefficient is actually a measure of how strongly connected

or correlated to different variables are It's also a measure

of how close the points on a scatter plot are

to the vest Fifth line this thing running through them

A correlation coefficient is kind of like a ranch hand

who's in charge of hurting data Okay so let's take

a closer look at the data points in our corral

taken from wild pizza restaurant Yeah they're a set of

by vary it or to variable data In this case

the data points on the x axis are the number

of minutes a table has to wait for their food

since ordering and the data points on the y axis

are the percentage of the total bill left as a

tip Interesting correlation here Pete the owner namesake of wild

pete's pizza believes there's a relationship between how long a

table waits for the food and how much they tip

generally the first step in finding a correlation coefficient is

to determine if the data points are in a roughly

leaning your pattern So we need to whip up a

quick scatter plot like this thing If the data points

don't have an obvious linear pattern lily shouldn't even bother

to calculate the correlation coefficient because it's not meaningful Once

there appears to be a linear or roughly linear pattern

to the data it's time to get calculate their partner

okay The formula for the correlation coefficient which is denoted

by the variable are here was a bit unwieldy and

typically the correlation coefficient calculated using an actual calculator of

some kind But still it's nice to know where these

numbers come from so we'll do it by hand and

double check our work So the process goes like this

First we find the mean in standard deviation in the

ecs data in the wide out of treating each set

of data as its own list separate from each other

We'll use a calculator just a shortcut this part of

the process and now we need to take its data

point in the x list Subtract the mean from it

and divide that result by the standard deviation so twelve

months fifteen point one six six seven which is negative

Three point one six seven divided by five point six

blah blah blah which is negative about a half then

twenty minus fifteen point one six seven which is four

point eight three three divided by five points You bubba

blah blah blah which is point eight six and change

and so on But we need the lather rinse Repeat

that same process of subtracting the mean of the y

data from each y value and then dividing the standard

deviation in the y values Right Well that'll be sixteen

months Fourteen which in california is too divided by three

point two eight blah blah blah which is point six

and change So we have thirteen months fourteen which is

negative one divided by three point two eight six which

is well negative point three ish So now we need

to multiply each matched acts And why value from our

previous calculations That'll be negative Point five six and change

times a point six blah blah blah which is negative

Point three four for one Then we have point eight

six three times negative point three oh four which is

a negative point two six two Then negative point seven

four four times one point two one seven two which

is Well what is that Negative point nine and so

on Now he's some the values we just got which

is all this stuff We adam all up and it

comes out to negative Four point four five five four

Okay one last step here Cowpokes We just need to

divide one less than the number of data points We

have six data points So we divide by negative Four

point four five five four yeah by five Divide that

And that means our correlation coefficient or our value is

negative Point eight nine one one Interesting Excellent Well now

we have a real correlation coefficient also What does it

mean Well for starters we can interpret what it actually

means here Say we did their correlation coefficient or our

value is a measure of how strong your relationship is

between the two variables Assuming that linear ish pattern exists

It does not however mean that the one variable causes

the other It just means there's some kind of relationship

between them toe actually put a value on how strong

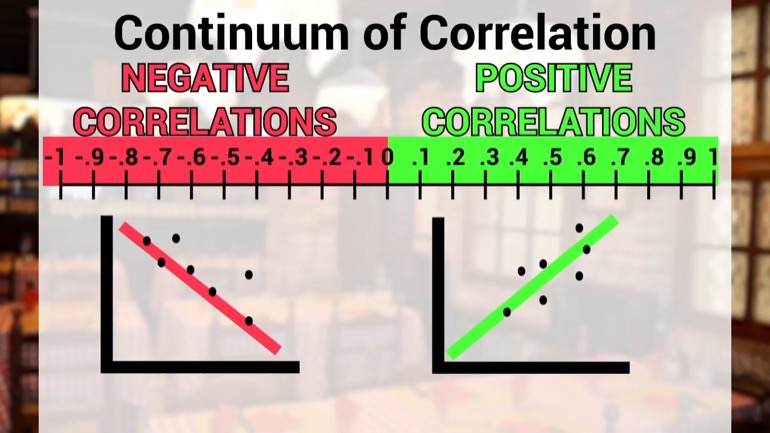

the correlation is We need to examine the continuum of

correlation Positive correlations represent situations where the scatter plot appears

to climb from left to right Negative correlations represent situations

where the scatter plot appears Toe fall from left to

right like our tips versus time data Well strong correlations

or values between point seven and one for positive correlations

and between negative point seven and one four negative correlations

That's just rough Numbers They're about point 7 And if

it's a one to one relationship it means that if

you let go of the apple it will fall every

time we're assuming they're on earth Scatter plot points will

be pretty darn close to the best fit line through

the points there medium correlations are in the point for

two point seven range and they got the negative ones

And so on Scatter plot points will be a we

distance from the best fit line Then it's not White

is tightly packed around that line and then we correlations

and just looks like a cloud It's like values from

zero two point for and zero negative point for and

they're just kind of like maybe there's a line through

there but maybe not well in our case it's our

our value is negative point eight nine one one While

it's very very negatively correlated between the two time of

ordering the food and when it shows up and the

tip paid at least the tip percentage of the meal

Which means that as it takes longer and longer for

food to arrive after ordering in general the tip percentage

goes down Also because this pattern is a strong correlation

this pattern is likely to be predictable in terms of

a certain weight time leading to a certain percentage A

while back we mentioned that our values aren't often whipped

up by hand Instead we use graphing calculator spreadsheets websites

any of them you know to whip up a mess

of our values in no time Pop the data into

the list one into in a t i a graphing

calculator Go to the count menu in the stat function

and run a lynn rag Linear regression You know we

see in our value of ours a negative point eight

nine one which is very close to our by the

hand value of point eight nine hundred eleven year negative

and is on ly different dude around it So yeah

when you need to rustle up in our value y'all

should probably grab something Check unless you want to go

through the headache of finding that our value by hand

remember that the r value just suggests a relationship between

the variables revenues saying one causes the other correlation does

not equal causation Remember that tattoo that somewhere but not

on your own body Also remember that the stronger correlations

air closer to negative one in one and farther from

zero in the middle And finally when they all go

to a restaurant and takes a spell get your order

Don't take it out on the server by stiffing them

on the tip There's a strong positive correlation between stiffing

service on tips and you know getting your food spat

in next time And while just being a massive

Up Next

What is inverse correlation? An inverse correlation is a relationship between two variables in which one moves in the opposite direction to the oth...